Bear Markets Come and Go. Let's Review Historical Performances.

Submitted by MIRUS Financial Partners on March 23rd, 2020

When a bear market hits, it's tough to be optimistic, but smart investors look to market history to determine the likelihood of a rebound, and the timing of market increases.

The End of the Longest Bull Market in History

It's easy to forget that we've just come off the longest bull market in history. The last market increase lasted almost 11 years before coronavirus fears and the realities of a seriously disrupted U.S. economy brought that record-breaking bull market to an end.

However, for investors who are worried about market volatility that is driven by disheartening news, don't forget that every bear market in the past has been a short period and a part of a long-term climb.

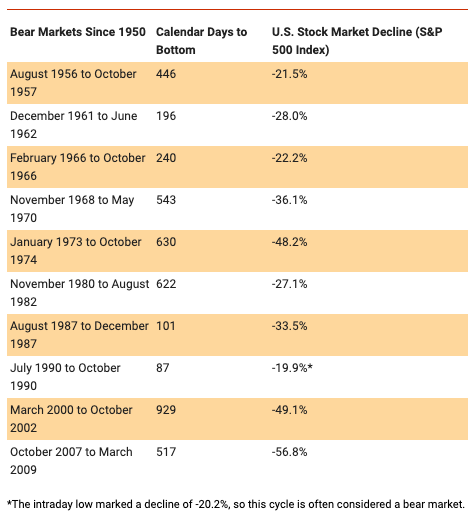

This is the 11th bear market since 1950. In each of the previous downturns, the market has rebounded eventually.

The History of Bear Markets

A bear market is usually defined as a decline of 20 percent or more from the most recent high. Bull markets are usually defined as increases of 20 percent or more from the bear market low. But there is no official term or percentage, so different people define the market cycles differently.

On average, bull markets lasted longer (1,955 days) than bear markets (431 days) over this period, and the average bull market advance (172.0%) was greater than the average bear market decline (-34.2%).

Source: Yahoo! Finance, 2020 (data for the period 6/13/1949 to 3/12/2020)

Opportunities Exist Within a Bear Market

Additionally, investors are wise to remember within any bear market there are buying opportunities. Just as in any bull market, some stocks diminish in value. A qualified financial professional can guide you towards opportunities in a bear market.

If you're reconsidering your current investment strategy, remember historical patterns, and try not to panic. A well-considered asset allocation and diversification strategy is still the foundation of a good investment strategy. If you're concerned about your investment portfolio or want to review your investment strategy, please call or email Mark Vergenes at 717-509-4521 or mark@mirusfinancialpartners.com.

***

The return and principal value of stocks fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

The S&P 500 is an unmanaged group of securities that is considered to be representative of the U.S. stock market in general. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Past performance is not a guarantee of future results. Actual results will vary.