Should You Invest Outside of the U.S.?

Submitted by MIRUS Financial Partners on March 20th, 2023

Investing in equities in other countries may provide an exciting opportunity for investors to diversify their portfolios and gain exposure to international markets. However, while there are many similarities to domestic markets, additional factors must be considered. That's why it is crucial to understand the potential risks and challenges associated with investing in foreign markets.

More Choices

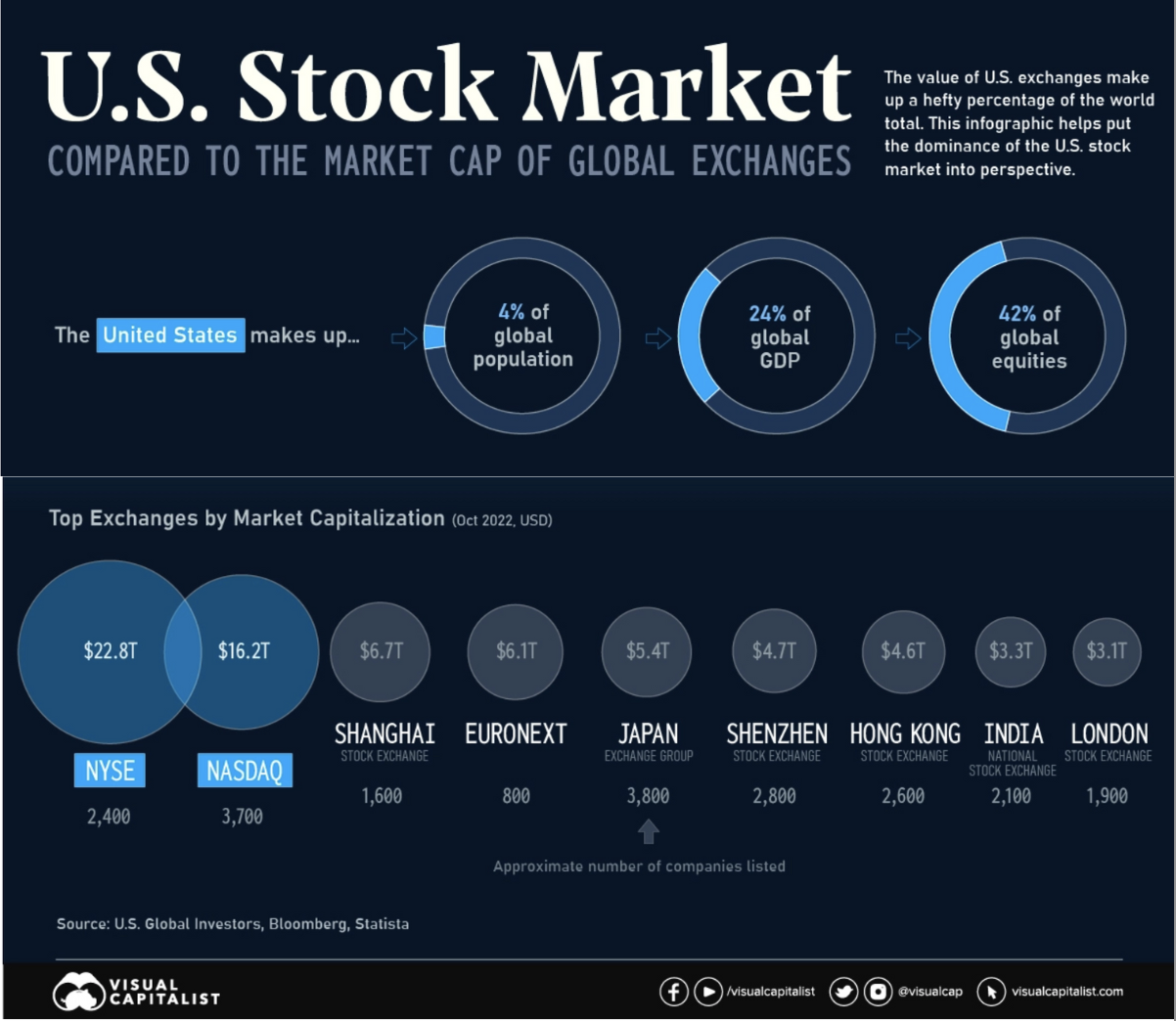

The U.S. Stock Market dominates the world market, but that doesn't mean it offers everything. Looking for investments outside of the United States can offer a much bigger playing field: There are about four times more publicly traded international companies than U.S. equities.1

The Appeal of Emerging Market Equities

Developed-market equities invest in financially mature regions such as Europe, Japan, and the United States. In contrast, emerging-market (E.M.) equities invest in developing countries such as China, India, and Africa.

E.M. economies tend to experience faster economic growth due to factors such as population growth, rising incomes, and expanding consumer markets. This can potentially lead to higher returns for E.M. stocks, but it also comes with increased risks, such as political instability, currency fluctuations, and weaker regulatory frameworks.

E.M. equities also have the bonus of demographic tailwinds, meaning that the young and growing population in these countries may drive future economic growth and consumption, potentially boosting the performance of E.M. stocks.

Hedge Against the Risk of Investing in a Single Economy or Currency

By diversifying globally, investors can potentially reduce overall portfolio risk by spreading their investments across different markets, industries, and currencies.

Additionally, international equities can help investors hedge against the risk of a single economy or currency. For example, if the U.S. economy experiences a downturn, investments in international equities may provide a buffer to help offset losses. Similarly, if the U.S. dollar weakens, international equities may appreciate, providing a currency hedge.

International Stocks Sometimes Outperform U.S. Markets

American and international markets have historically traded multi-year periods of outperformance, and the U.S. market has outperformed for the past decade. However, international stocks finally outperformed in 2022, which suggests that the cycle may have shifted.

While past performance is not a guarantee of future results, it is possible that international stocks may continue to outperform U.S. stocks in the coming years. Several factors could contribute to this, such as:

- Valuation: International stocks may be relatively undervalued compared to U.S. stocks, making them more attractive to investors.

- Economic growth: Many emerging market economies are expected to grow faster than developed economies in the coming years, which could lead to more robust performance for international stocks.

- Currency: If the U.S. dollar weakens, it could boost the performance of international stocks, as they would be worth more in U.S. dollar terms.

Sometimes a Bargain?

Relative to the U.S., international stocks are cheaper, pay higher dividends, and have valuations well below their historical average.2 These characteristics may draw investors who seek to capitalize on lower prices and potential appreciation.

The price-to-earnings (P/E) ratio is a commonly used valuation measure in the stock market. For example, as of early 2023, the P/E ratio of the MSCI EAFE Index, which tracks developed international markets, was around 16, compared to a P/E ratio of about 22 for the S&P 500 Index, which tracks U.S./ stocks. This suggests that international stocks are relatively cheaper than U.S. stocks.

In addition, many foreign stocks pay higher dividends than American stocks. For example, the dividend yield of the MSCI EAFE Index was around 2.5% as of early 2023, compared to a dividend yield of around 1.5% for the S&P 500 Index.

The Effect of a Weaker Dollar

A weakened dollar can make international investments more attractive to American investors, who can benefit from currency appreciation. This can provide a natural currency hedge for domestic investors, as international investments can appreciate when the U.S. dollar weakens, offsetting potential losses in other areas of their portfolio.

When the American dollar weakens, it becomes cheaper for foreign companies to borrow money, which can help boost profits. In addition, a weaker U.S. dollar can make exports from foreign countries cheaper, leading to increased demand for those exports and higher revenues for international companies.

However, it is important to note that a weaker U.S. dollar can also lead to inflation and higher import prices, which can harm the American economy and markets. In addition, currency fluctuations can be volatile and difficult to predict, making investing in international equities riskier.

Measure Risks Carefully

Like all investments, international investing has its own set of risks. Investors may be subject to currency volatility, geopolitical disruptions, and liquidity risks that differ from American investments. To help navigate these risks, it may be beneficial to access international stocks through professional active management. Contact Mark@MirusFinancialPartners.com to find out if international investments make sense for your long-term financial goals.

1 As of 12/31/22. Data Source: Bloomberg, 2/23.

2 As of 12/31/22. Data sources: FactSet and Hartford Funds, 2/23.