As Private Sector Pensions Disappear, Gen X is turning to Annuities

Submitted by MIRUS Financial Partners on January 20th, 2022

Generation X, or Gen X, typically refers to Americans born between 1965 and 1980. They’re 65 million strong and heading towards retirement age, with the first Gen Xers reaching age 65 in just eight years.

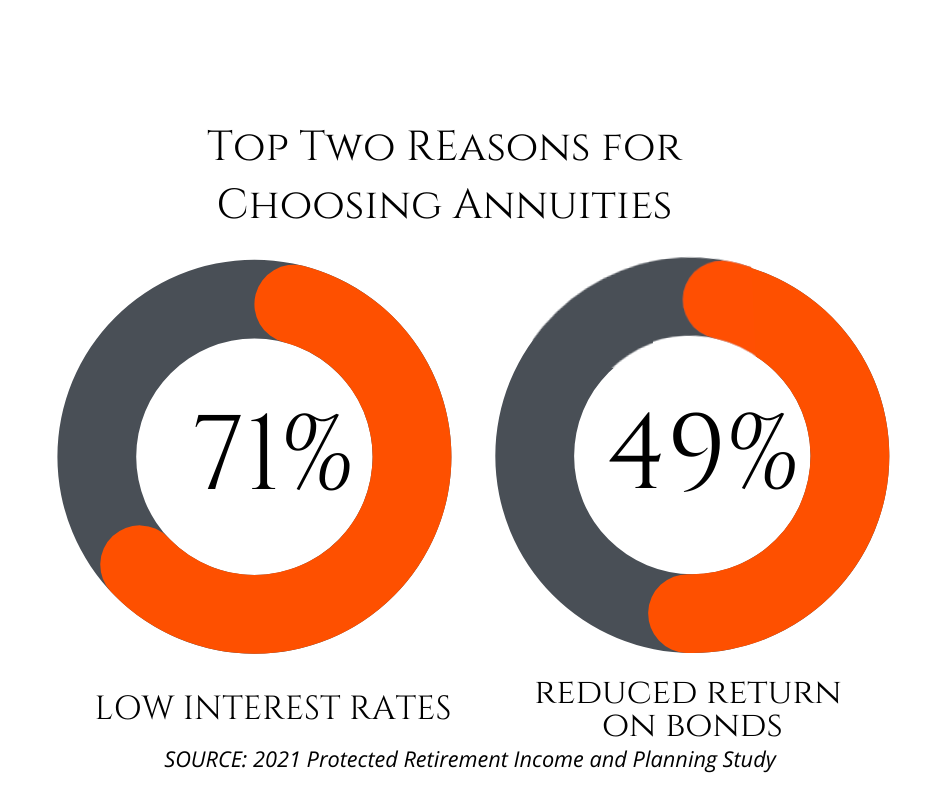

This age group may treat retirement differently than other generations. According to the 2021 Protected Retirement Income and Planning Study, a joint research effort by the Alliance for Lifetime Income and CANNEX, about 7 in 10 Gen Xers are interested in using annuities to supplement their retirement income.

There are many types of annuities. All types of annuities offer a low-risk form of income, and nine out of ten of Gen Xers in this study reported that protected income is a top concern. Annuities are contracts with insurance companies that make regular payments to the investor. For those who have maxed out their annual contributions to 401(k)s or IRAs, an annuity may be a way to maximize tax-deferred retirement savings. The IRS does not put a contribution cap on deferred annuities, allowing investors to save more.

While 401(k)s and other tax-deferred accounts often come with required minimum distributions (RMDs) around age 70, some types of annuities don’t mandate RMDs, so they can also act as a long-term savings account allowing seniors to hold onto the funds as long as desired.

As with most low-risk forms of investment, annuities offer lower rates of returns, often on par with a bank's CD rate. However, unlike CDs, annuities are tax-deferred, making them an attractive way to save for retirement.

Annuities also have insurance features. For example, if an investor passes before receiving income payments, many contracts ensure that a beneficiary will receive a specified minimum amount that is at least equal to the amount of purchase payments. It may also offer the ability to make withdrawals up to a certain amount annually.

Annuities can be a complicated form of investing, and each type of annuity has specific benefits and disadvantages. It’s wise to contact MIRUS Financial Partners to discuss options and ensure your annuity choice has the features and advantages you desire.

While annuities are a low-risk form of investing, an annuity is not without risk. The guaranteed return is only as strong as the insurance company that issues the annuity. There may be state guarantees in the event of an insurance company's failure, but annuities are not guaranteed by the FDIC, SIPC, or any other federal agency.