How Does Inflation Affect Investment Strategies?

Submitted by MIRUS Financial Partners on June 22nd, 2021

Fear of market volatility can make seemingly safe investments appear alluring. The downside of playing it “safe,” however, is that you may actually be losing purchasing power by putting your money in investments that don’t keep pace with inflation.

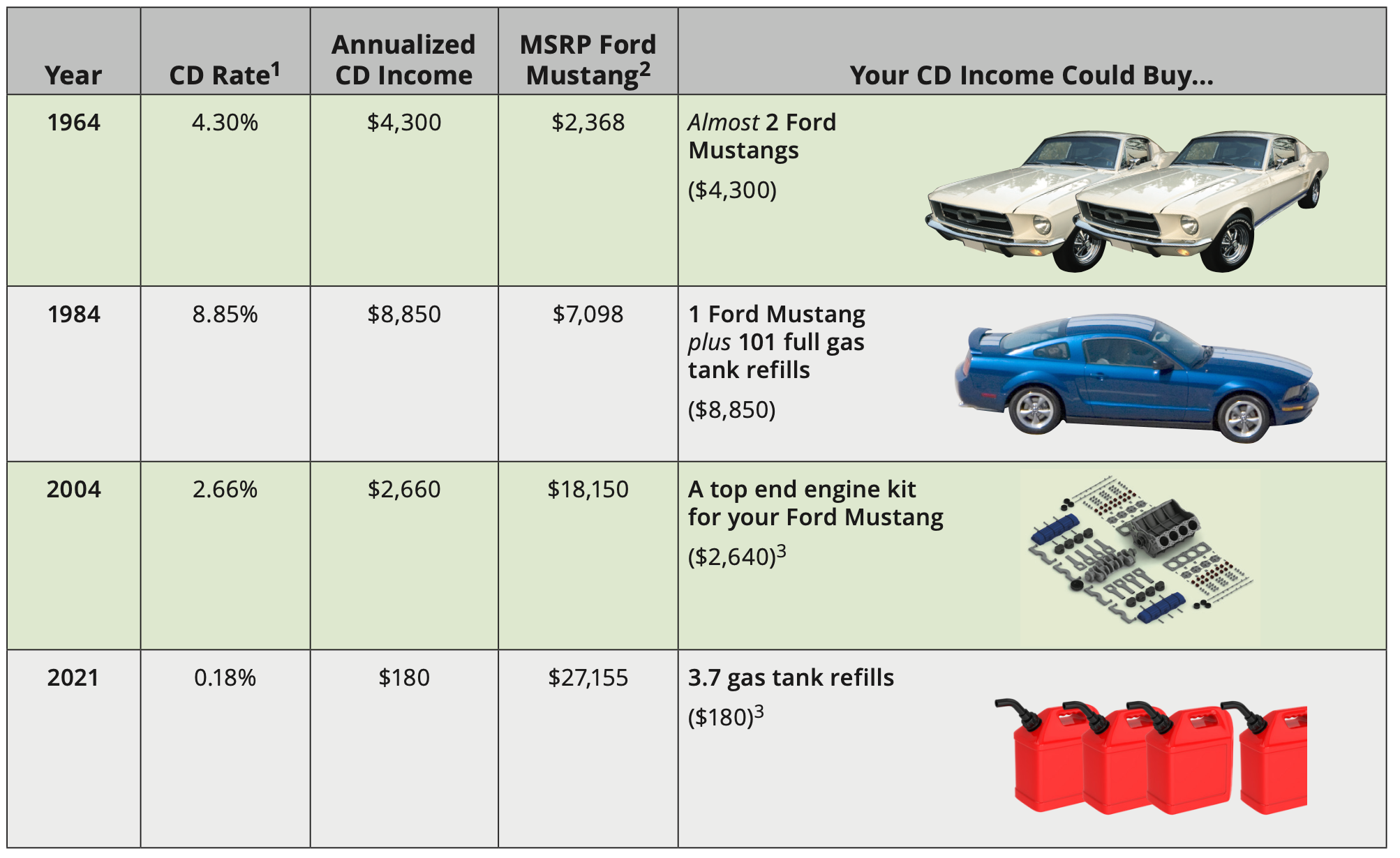

For example, when the Ford Mustang launched in 1964, the cost of a '64 standard coupe was $2,368. Back then, $100,000 invested in a 6-month CD would have provided you with $4,300 in annualized income—almost enough to buy two Ford Mustangs!

Unfortunately, the income on the same $100,000 CD today wouldn't even provide you with enough income to pay for four gas tank refills for your cherished Ford Mustang. The speed of a Mustang is apparently no match for the speed of inflation!

The Effects of Inflation: $100,000 6-Month CD Investment

Chart courtesy of Hartford Funds

Is it time to talk about investments with the potential to outpace inflation?

CDs are insured by the FDIC, offer a fixed rate of return, and are generally designed for short-term savings needs. The principal value and investment return of investment securities (including mutual funds) are subject to risk, will fluctuate with changes in market conditions, are generally considered long-term investments, and may not be in the best interest of all investors.

1 Data Sources: Federal Reserve, BankRate.com, and Hartford Funds, 5/21. CD rate for 2021 as of 3/31/21.

2 Sources: cjponyparts.com and USnews.com, retrieved 5/21

3 Data Source: aaa.com, retrieved 5/25/21